A taxable scholarship/fellowship is not subject to FICA withholding since the payment is not for services. However, this is subject to changes in state legislation.

Currently, state taxes are not required to be withheld by the College even though the payments may be taxable in the state. income tax withholding at a rate of 14 percent unless tax treaty relief is available. Examples of stipends are payments that can be used for living and incidental expenses such as room and board, travel, nonrequired books and personal computers, etc.Ī stipend paid to a nonresident alien with an F1 or J1 visa is subject to U.S. Taxable scholarships are generally referred to as stipends and are payments for which no services are rendered or required. These payments do not need to be reported to the IRS by the student or the College.Ī scholarship/fellowship used for expenses other than qualified expenses is taxable income. Qualified expenses are defined by the Internal Revenue Service (IRS) and include tuition and required fees, and/or for books, supplies, and equipment required of all students in the course. You can also download New York state tax forms from the following website: Taxation of Scholarships, Fellowships, and StipendsĪ scholarship/fellowship payment is generally not taxable income provided it meets the criteria of use for "qualified expenses." If you filed form 8843 ONLY, you do NOT have to file New York state income tax forms.

If you worked in New York State, you might also have to file New York State income tax forms.

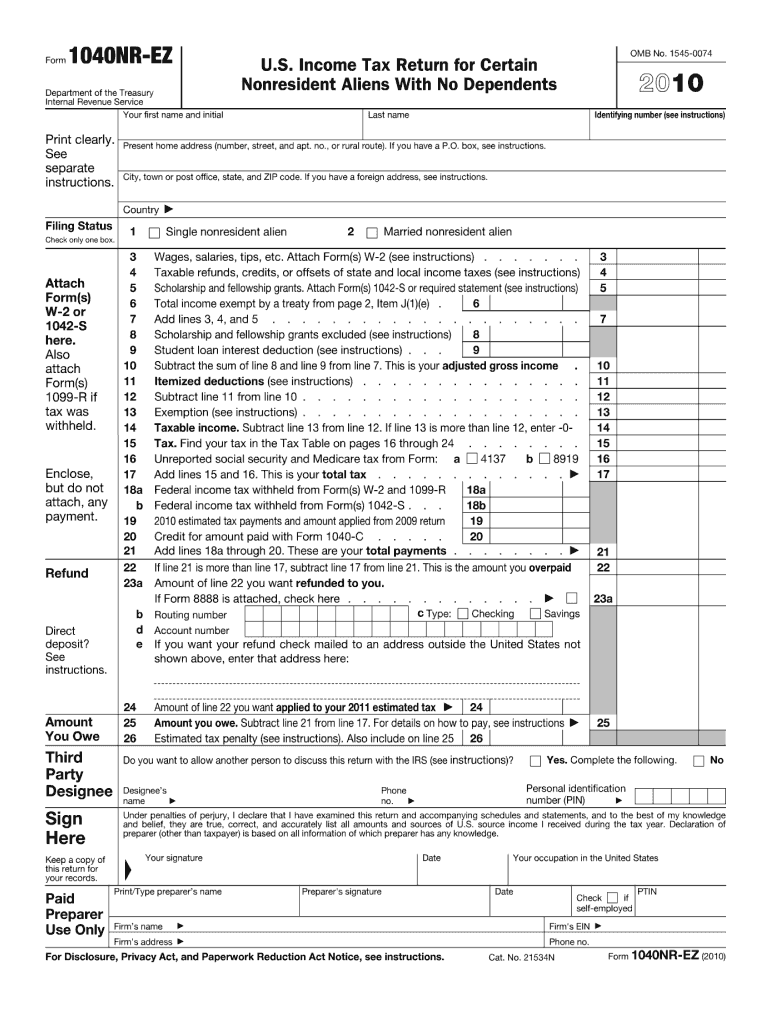

It is the responsibility of each international visitor to understand their own tax situation.įederal tax forms, instructions for form completion, and additional information regarding international taxes can be found on the IRS website. tax law is extremely complex and each foreign national's situation varies. Bard staff are not qualified to answer questions regarding individual tax liabilities, but can refer you to resources to help you with taxes in the U.S. You must have a Social Security number or Tax ID number to file 1040NR/1040 NR-EZ tax forms in the United States. More information about international tax responsibilities and eligible deductions can be found here. Earned income would be any monies received in the United States that are not considered qualified expenses as defined by the IRS. Individuals who earned income should file form 1040NR or 1040NR/EZ. Tax Information If you were in the United States but did not earn any money, you need to file form 8843 only.

0 kommentar(er)

0 kommentar(er)